Run portfolio monitoring as tight as dealflow

It’s time. Leave endless email reminders to founders and manual reporting behind. Become the proactive investor you say you are with a dedicated investor data cloud.

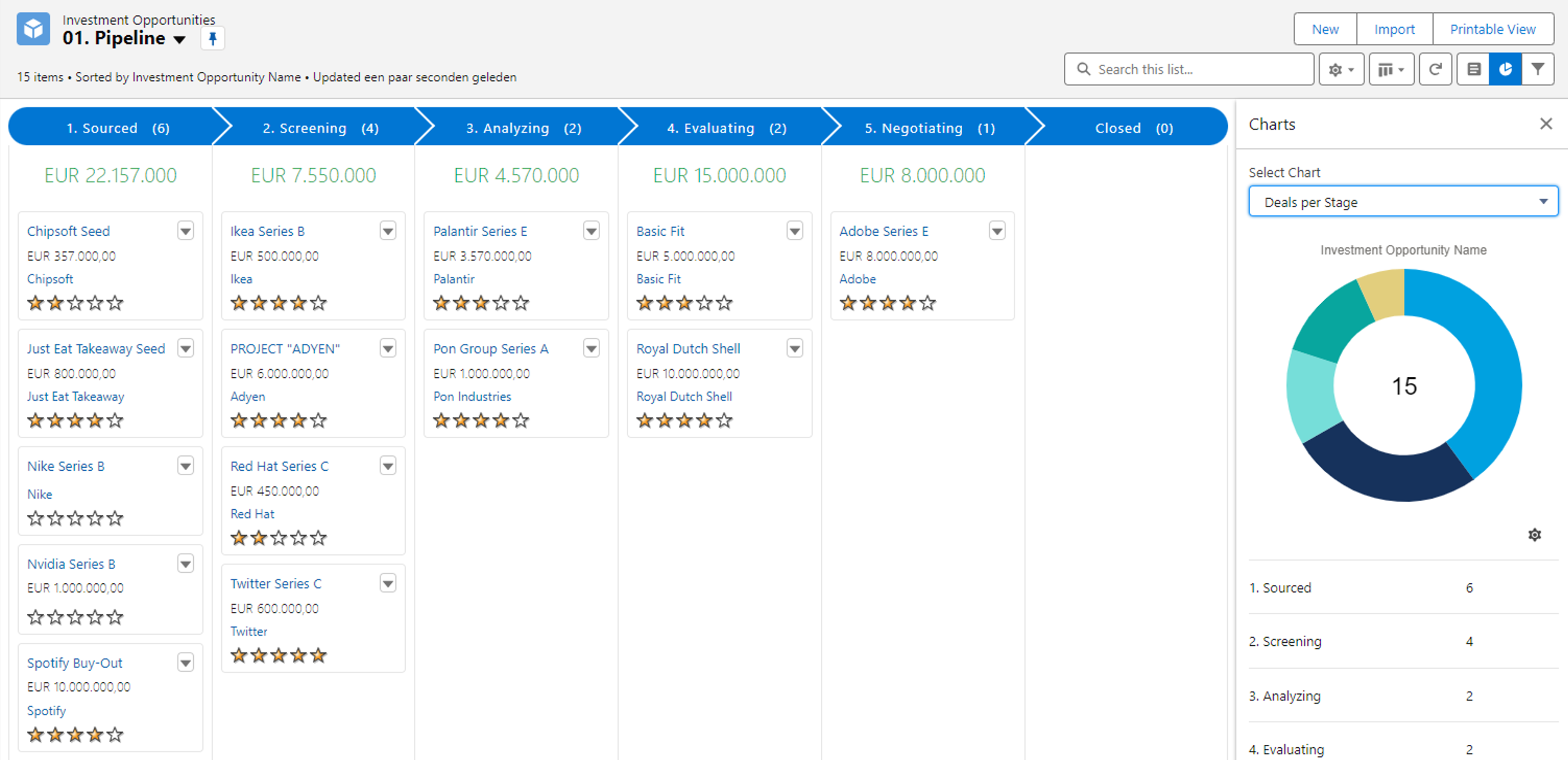

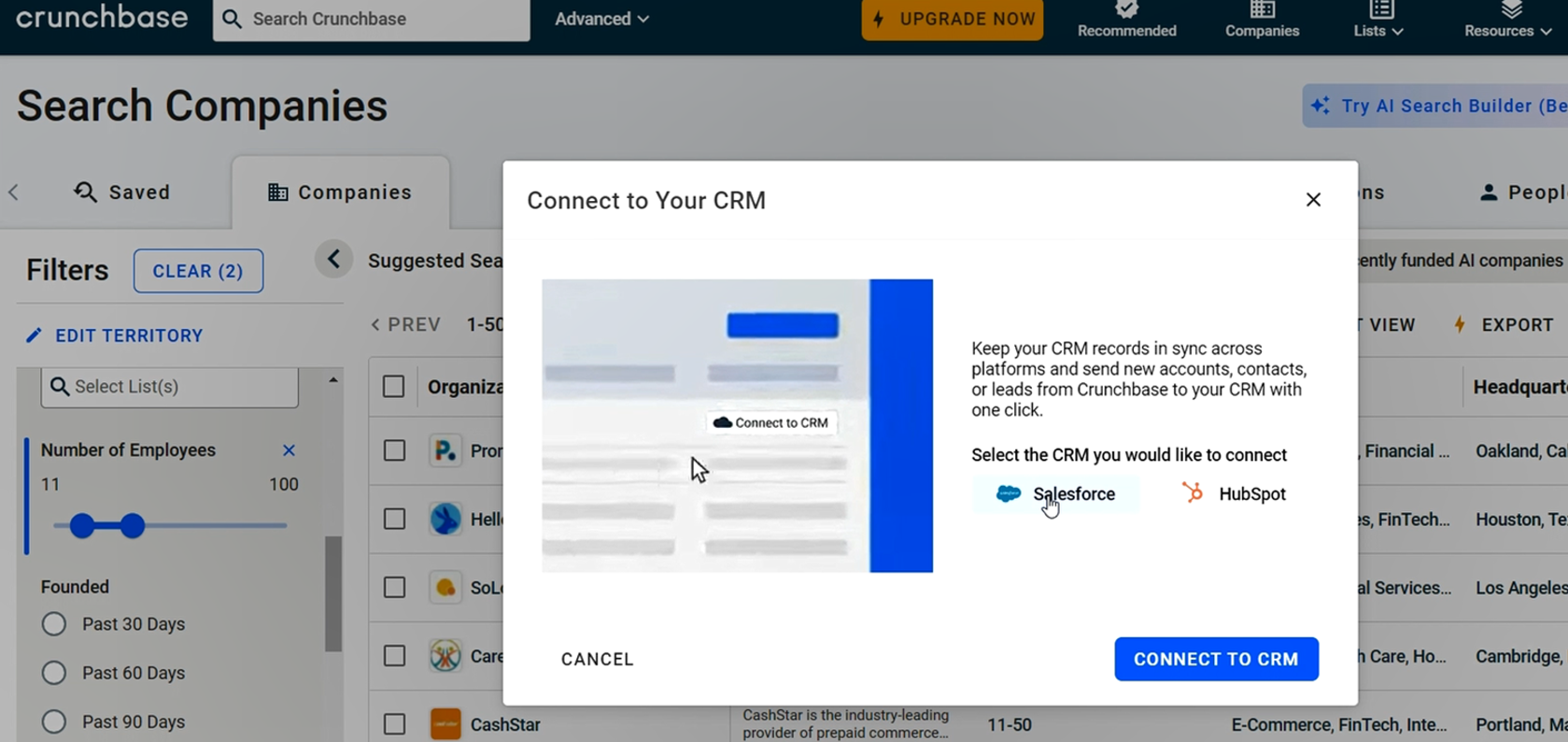

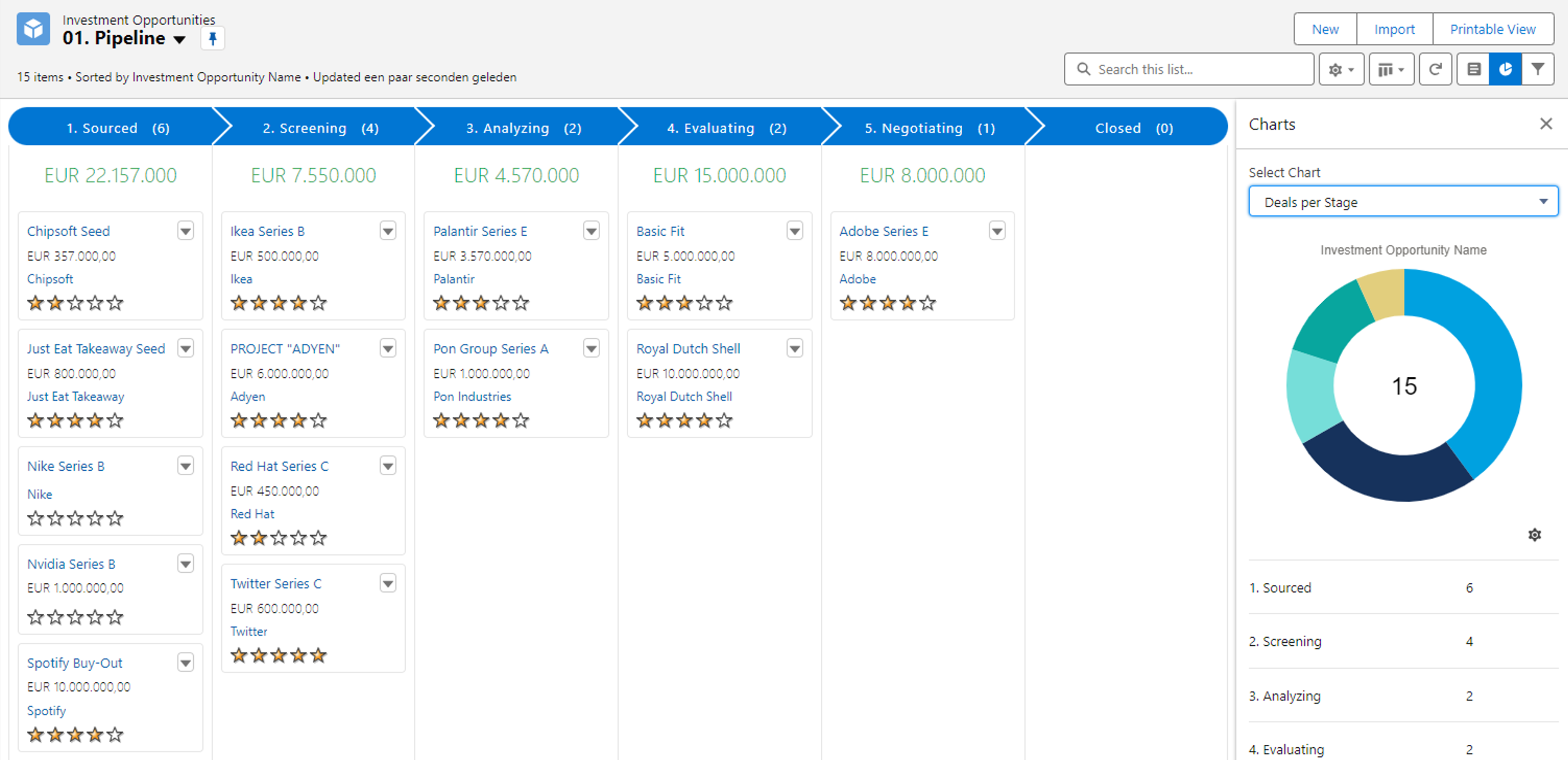

A glimpse of our dealflow module

Accelerate team performance

User-friendly kanban boards and automated activity tracking on every deal help you increase the execution speed of the whole team.

Better informed

Enrich new leads with data from multiple sources, providing users with complete investment opportunity profiles that are ready to be analyzed.

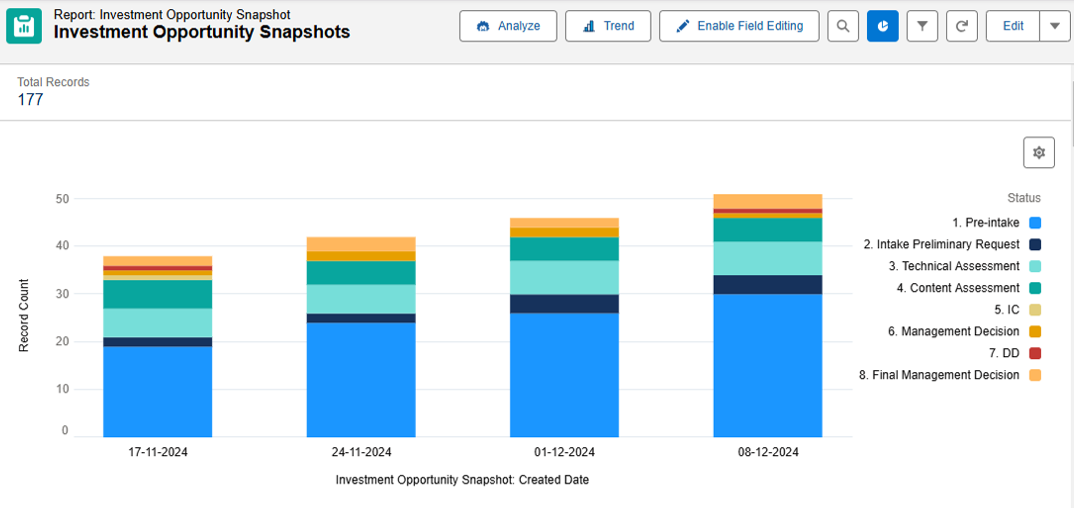

Get better as a team

Analytics help you increase the output of your dealflow efforts every month with insights in channels, conversion rates, and resource allocation.

User-friendly kanban boards and automated activity tracking on every deal help you increase the execution speed of the whole team.

Enrich new leads with data from multiple sources, providing users with complete investment opportunity profiles that are ready to be analyzed.

Analytics help you increase the output of your dealflow efforts every month with insights in channels, conversion rates, and resource allocation.

Clients using Venturelytic Dealflow

These teams continue to professionalize their dealflow processes and start their Monday morning dealflow meeting with Venturelytic.

Standard Investmentwww.standard.nl

Standard Investmentwww.standard.nl

Nalkawww.nalka.com

Nalkawww.nalka.com

Borski Fundwww.borskifund.com

Borski Fundwww.borskifund.com

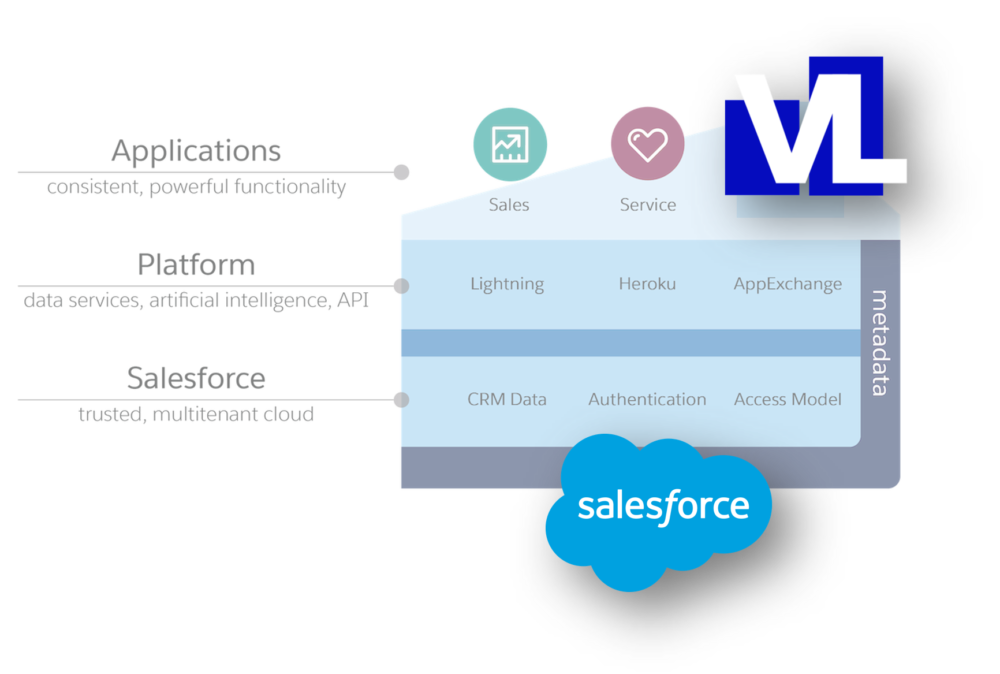

One central place to store all investment data

A single source for your fund’s most scattered data: with Venturelytic’s dedicated Investor Data Cloud, natively built on Salesforce - the world's #1 data platform - you'll always have the latest portfolio insights at your fingertips.

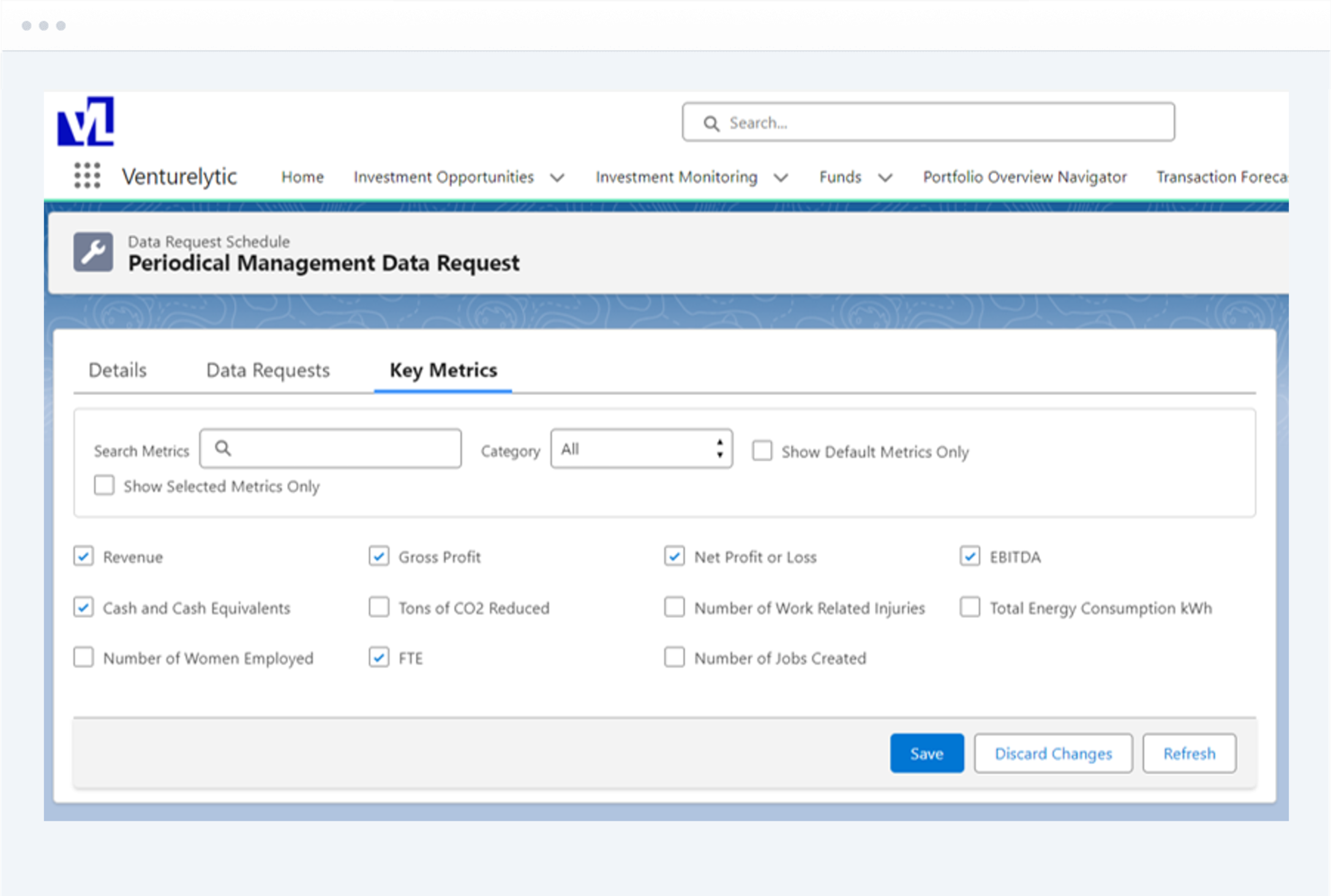

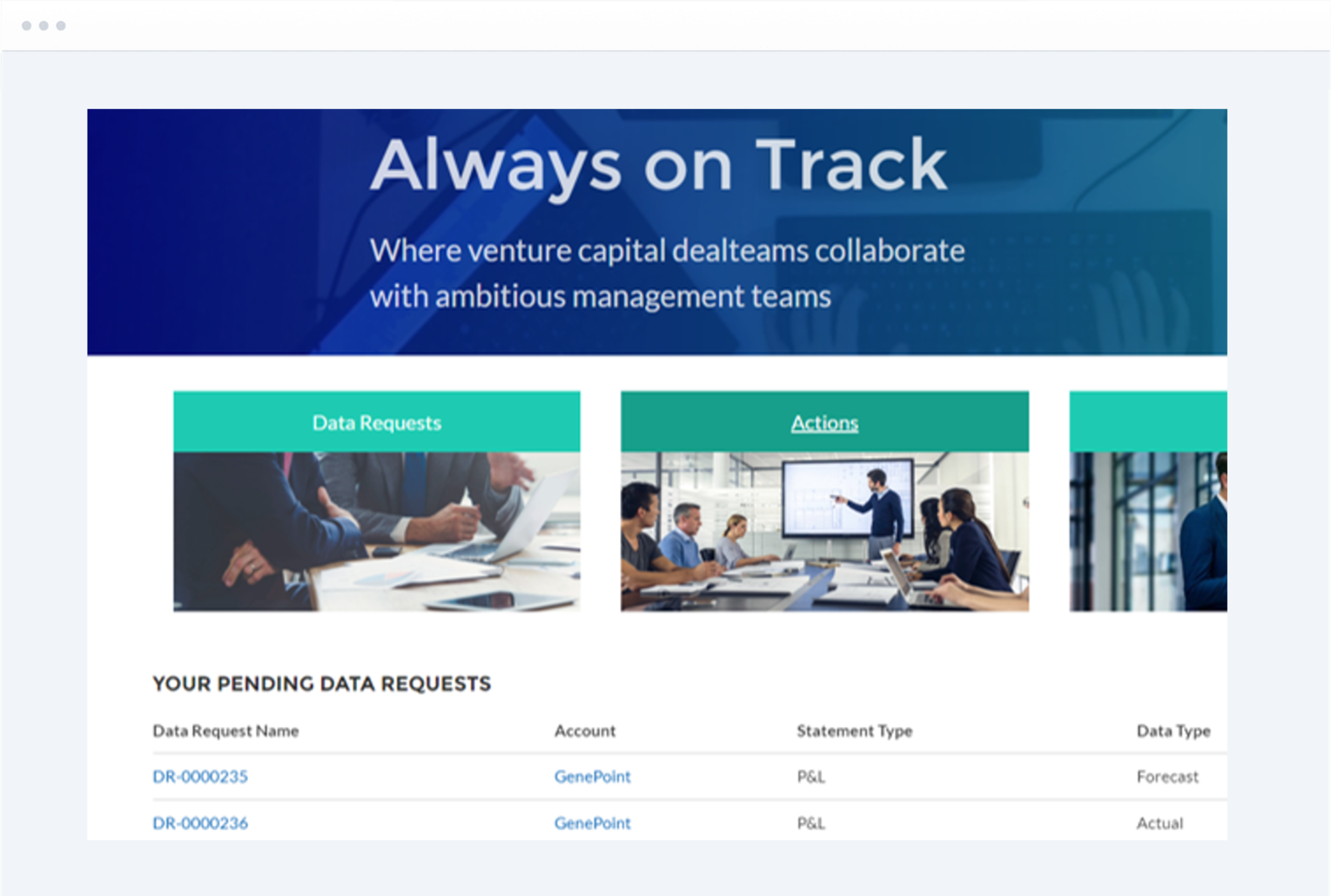

Extend your CRM with monitoring capabilities

Collecting complete portfolio company data on time without friction. No more struggling with emails and spreadsheets back and forth. With Venturelytic’s Venture Community, you provide your portfolio companies a frictionless experience.

Clients using Venturelytic Monitoring

Funds that turbocharged their CRM by turning monitoring on are able to generate portfolio overviews with just a few clicks.

Hamamatsu Ventureswww.cvc.hamamatsu.com

Hamamatsu Ventureswww.cvc.hamamatsu.com

ROM InWestwww.rominwest.nl

ROM InWestwww.rominwest.nl

Aqua Sparkwww.aqua-spark.nl

Aqua Sparkwww.aqua-spark.nl

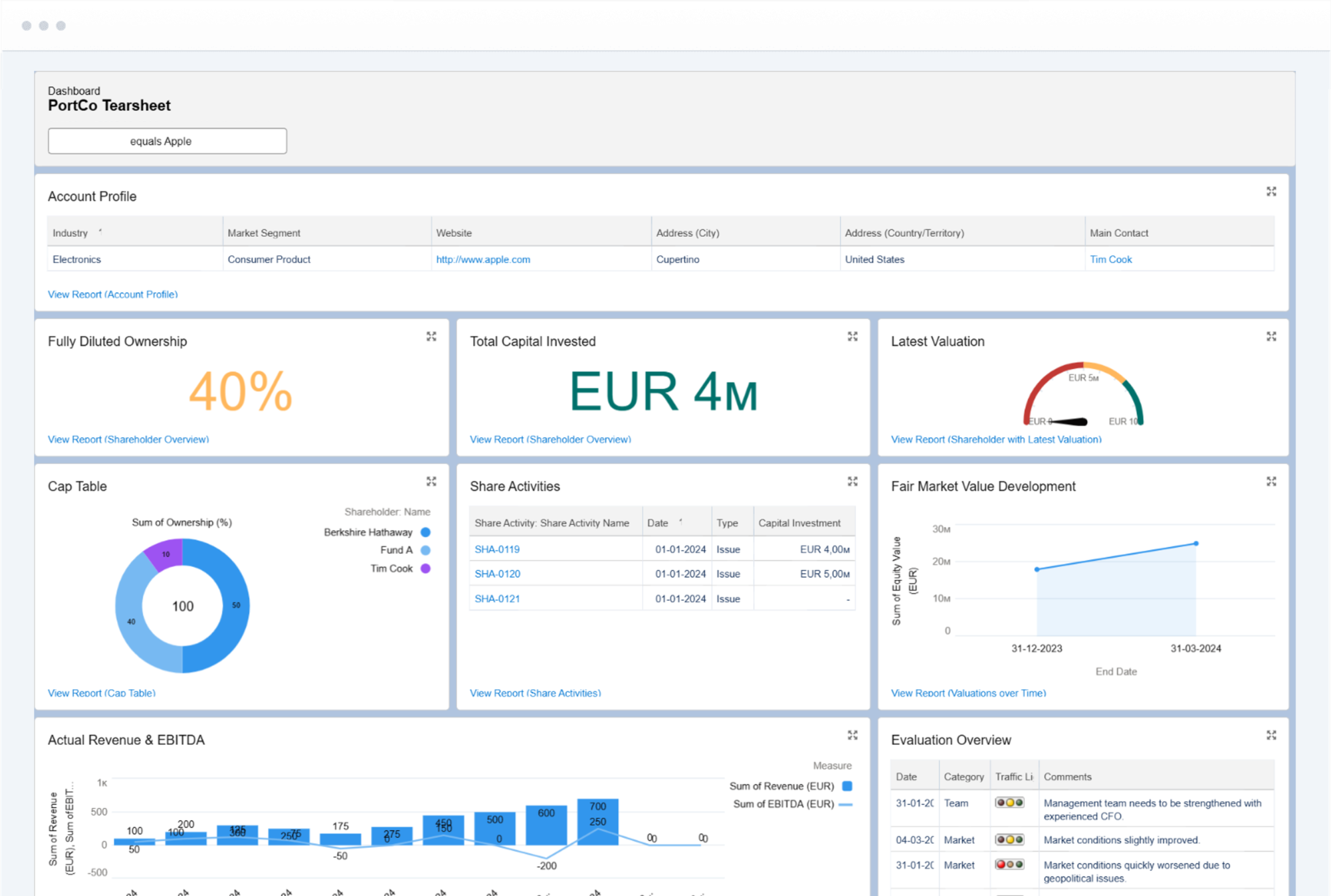

The overview you knew you missed

See all key metric data coming in, right after the end of the month, for each one of your portfolio companies. One dashboard with the most important metrics ensures you’re fully in control and know where to focus on next quarter.

A system ready to onboard your fund

Safe

Protect sensitive investment data with enterprise-grade security, powered by the world's most trusted CRM.

Connected

Choose from over 4000+ out-of-the-box integrations from the AppExchange to connect into your workflow.

Flexible

Tailor the platform to your fund's processes with page creators, no-code automations and custom reports.

Protect sensitive investment data with enterprise-grade security, powered by the world's most trusted CRM.

Choose from over 4000+ out-of-the-box integrations from the AppExchange to connect into your workflow.

Tailor the platform to your fund's processes with page creators, no-code automations and custom reports.