Finally, a simple way to manage your entire portfolio

Venturelytic's dedicated investor data cloud to help you streamline data collection, meet portfolio reporting needs, and spot value creation potential to achieve the growth you planned for.

Trusted by proactive investment managers

You’re always a step behind when it comes to your portfolio companies

Lack of data

Getting PortCo data is a hassle, every month again, for both yourself and your companies.

Manual reporting

You’re spending too much time and manual effort on reporting, every quarter again.

Reactive management

Your portfolio company data is all over the place, making it hard to stay in control.

Getting PortCo data is a hassle, every month again, for both yourself and your companies.

You’re spending too much time and manual effort on reporting, every quarter again.

Your portfolio company data is all over the place, making it hard to stay in control.

Use portfolio data to achieve the growth you planned for

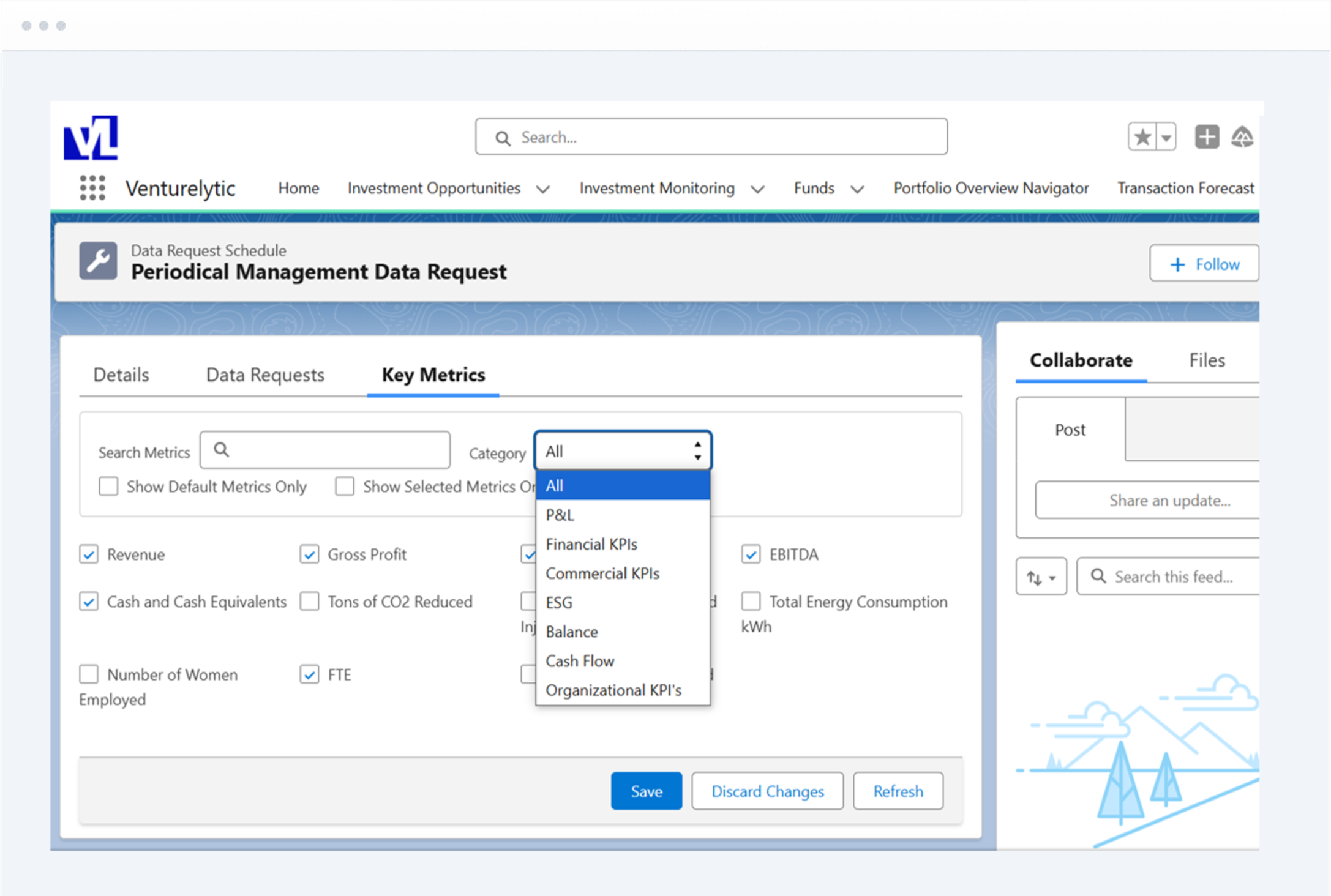

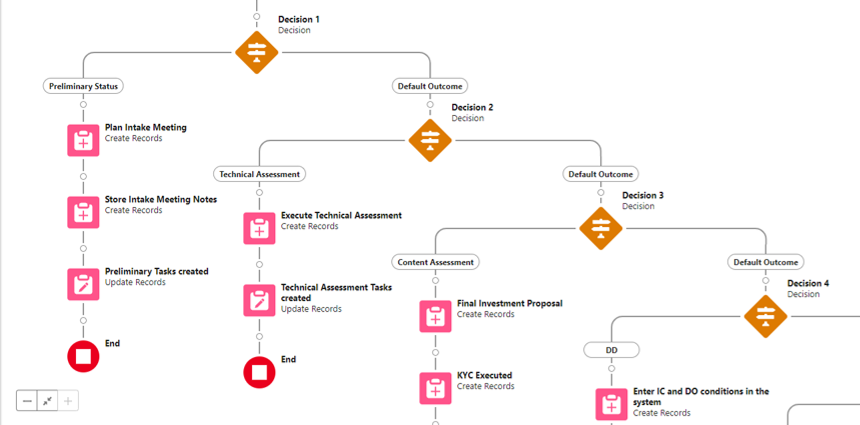

Venturelytic allows you to create customized experiences for every portfolio company with easy to setup automations that collect the data you need in time so you’re always in control.

Want to streamline dealflow too?

Check out our end-to-end platform

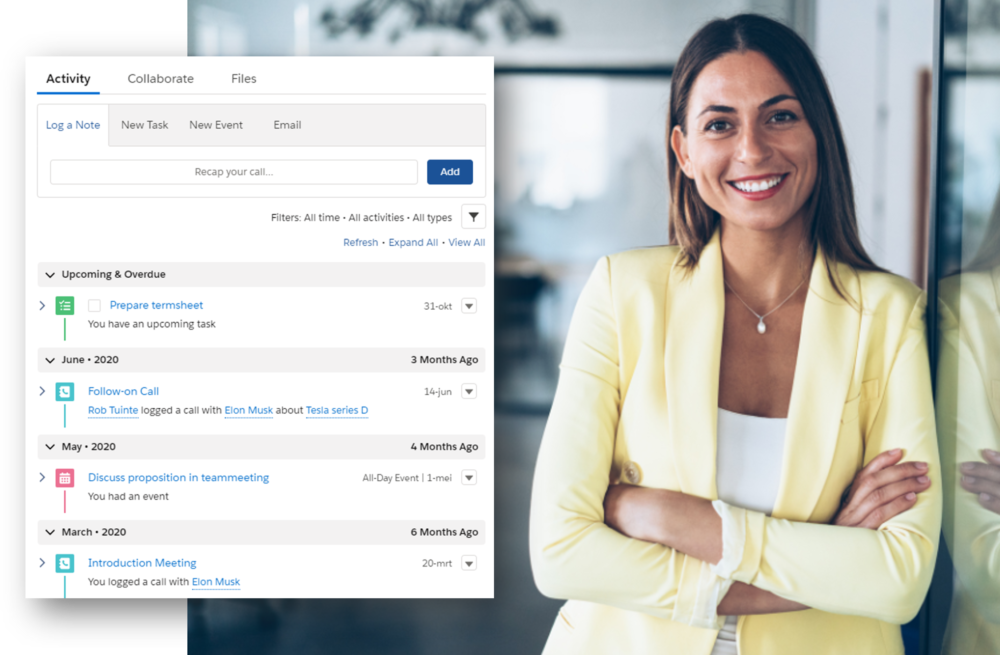

- Get the best of CRM + dealflow: Leverage proven dealflow best practices around sourcing, analyzing and reporting on top of the world's #1 CRM, Salesforce.

- Built for growing teams: For teams that take dealflow serious, start Monday mornings organized, and systematically gain full market visibility.

- Integrated into your workflow: Connect seamlessly with the tools you already use, from email add-ins to integrations with private company databases.

We help funds like yours

Private equity

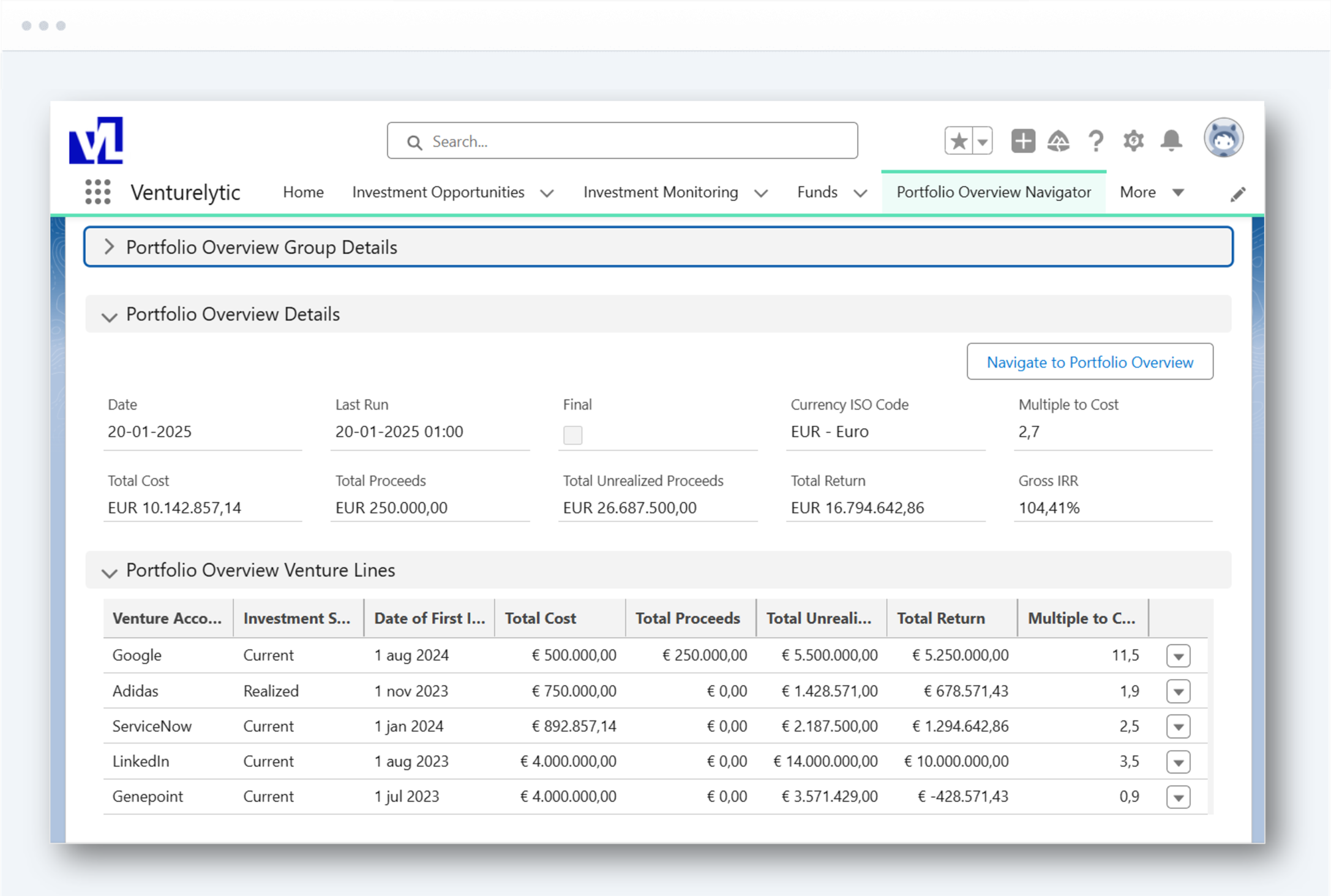

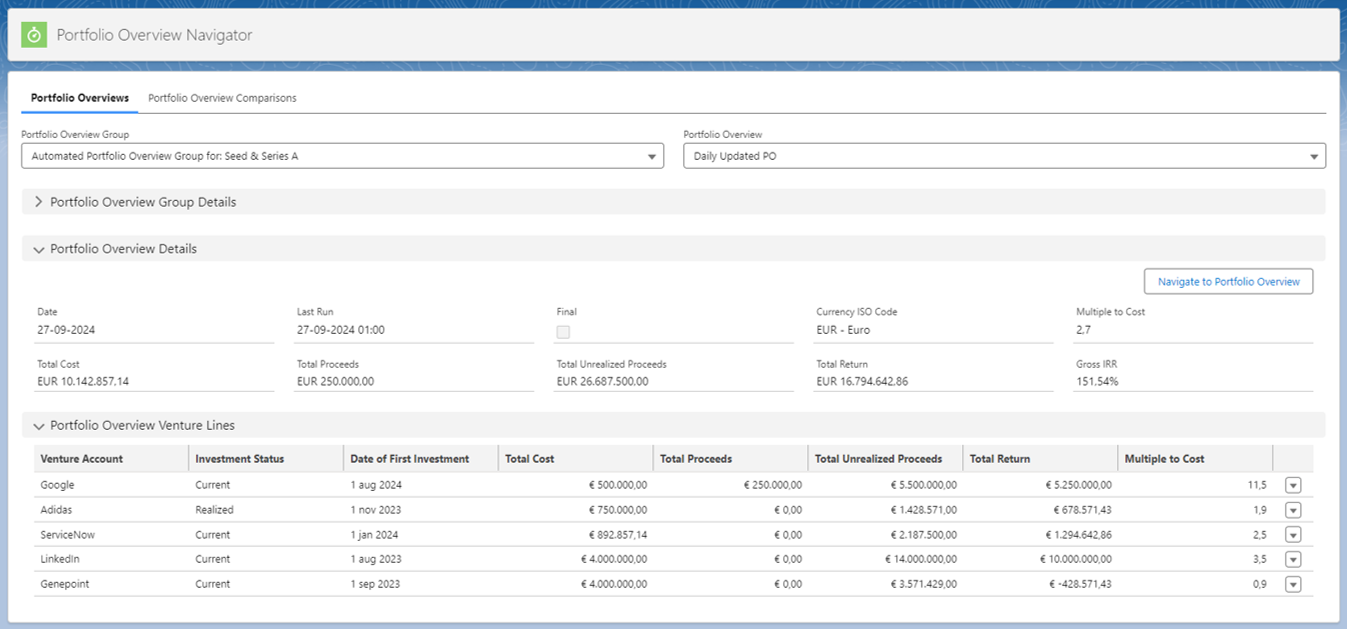

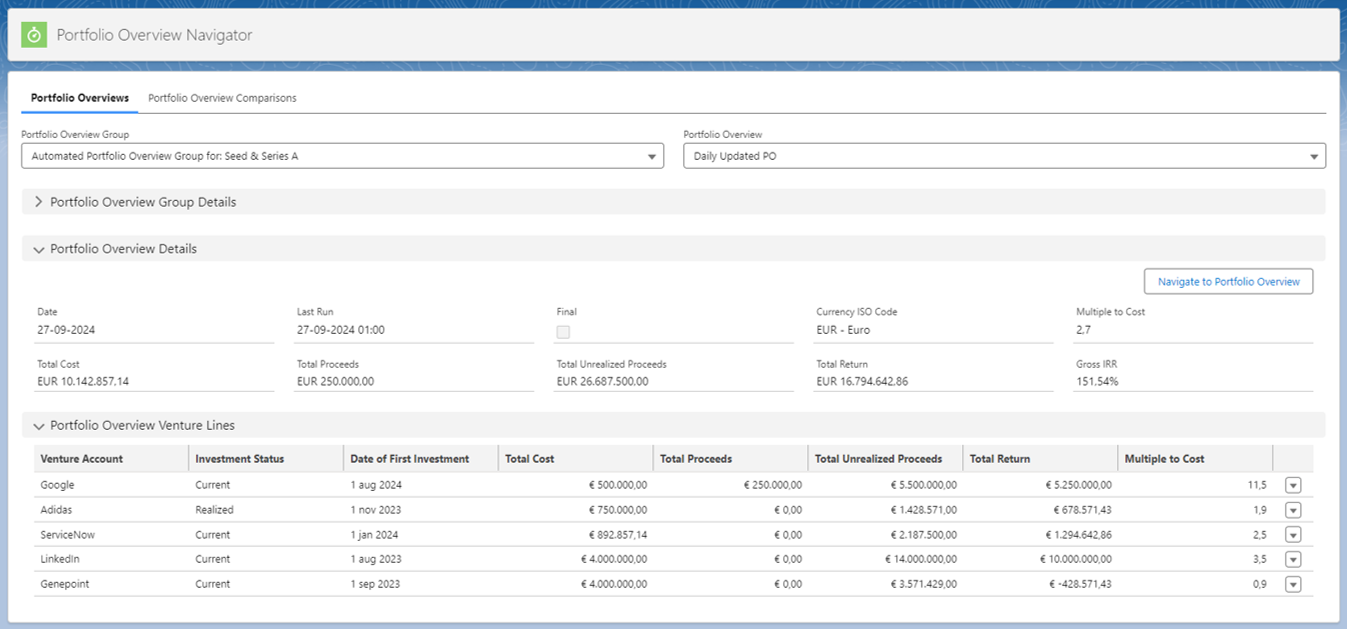

Maximize portfolio value by taking actions based on always up-to-date portfolio and company performance overviews

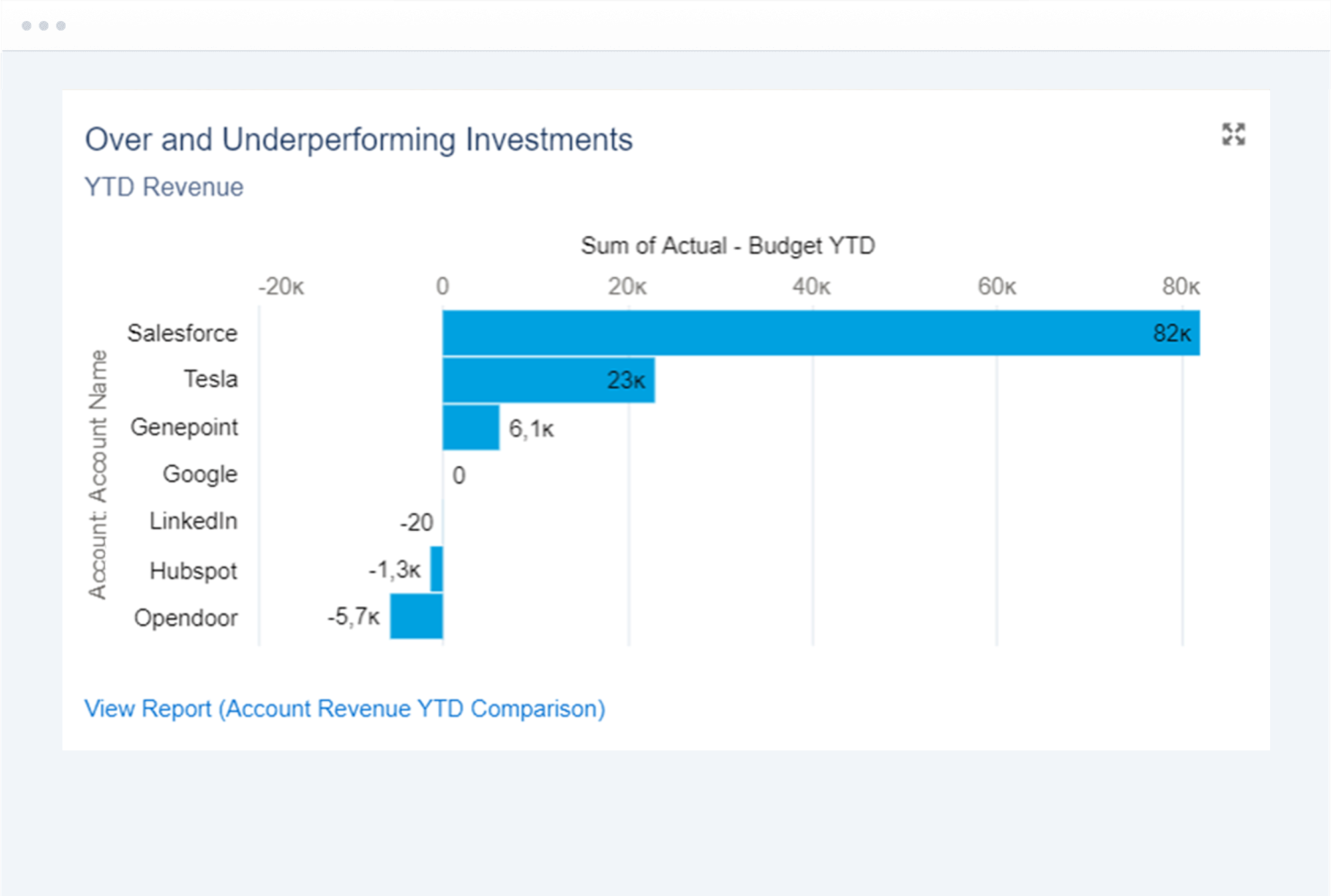

Venture capital

Significantly improve the success rate of your portfolio companies by collaborating closely with founders through a unified view of performance metrics.

Corporate venture capital

For top-tier corporate funds combining financial returns with innovation through the power of a dedicated investor data platform that can flexibly be configured to your unique processes.

Maximize portfolio value by taking actions based on always up-to-date portfolio and company performance overviews

Significantly improve the success rate of your portfolio companies by collaborating closely with founders through a unified view of performance metrics.

For top-tier corporate funds combining financial returns with innovation through the power of a dedicated investor data platform that can flexibly be configured to your unique processes.

Trusted by investors like you

Venturelytic gives us a clear overview of our dealflow activities and portfolio performance with insights that enable us to make well-informed decisions and maximize impact.

Ronald GelderblomInvestment Director

Venturelytic plays a crucial role in our fundraising process by enabling us to track all relevant investment data that we easily share within our team and with our external stakeholders.

Hidde-Jan LemstraPartner

We use Venturelytic as our core platform for LP, deal flow and portfolio management. Users are happy and Venturelytic is a knowledgeable sparring partner.

Sige VinkenChief Operating Officer

Investor Data Cloud®

One platform to supercharge the growth of your portfolio companies

Quickly find out how an Investor Data Cloud professionalizes your deal flow process and standardizes reporting for a growing portfolio of investments. Within minutes, you'll discover which areas the platform generates maximum impact for your fund and how it fits your team's way of work.